CU Risk Intelligence

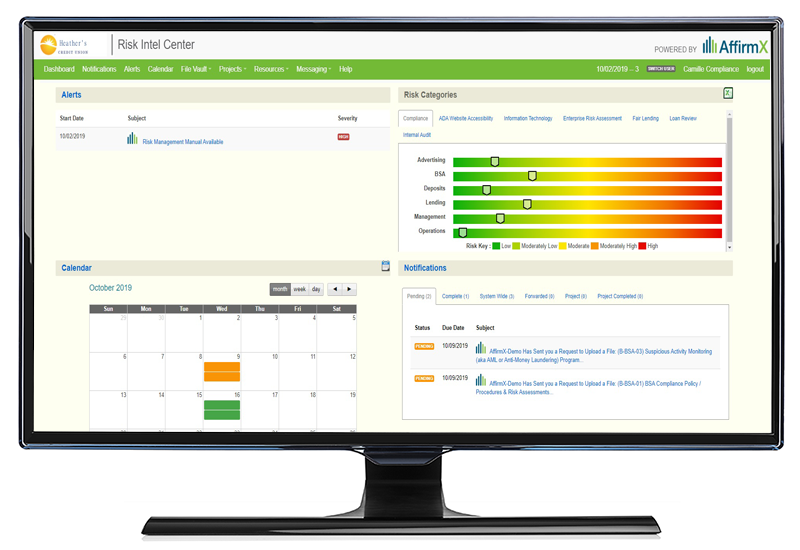

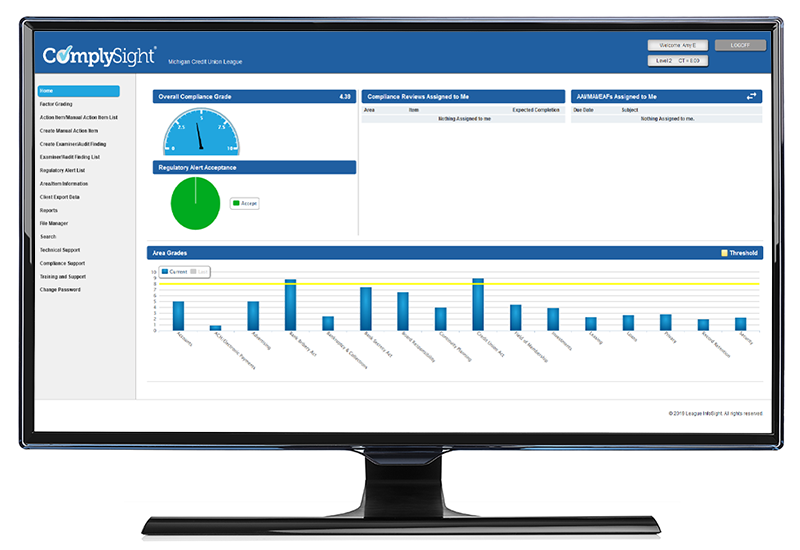

Combining the knowledge and expertise of industry leaders, CU Risk Intelligence's approach to governance, risk and compliance (GRC) management is to provide affordable solutions to credit unions of all sizes and sophistication.

With countless years of combined experience and broad range of expertise, our solutions are continually innovated by credit unions, for credit unions, in direct response to the pain points and challenges facing today’s financial services industry.

CU Risk Intelligence is a consortium of credit union leagues and credit union service organizations including CU Solutions Group, Cornerstone Resources, GoWest Credit Union Association, Indiana Credit Union League, League of Southeastern Credit Unions, Credit Union League of Connecticut, Maryland & DC Credit Union Association, and League InfoSight.